The Revent Newsletter: Spring 2024

Dear Reventors & Friends,

The long winter nights are gone, spring is in the air, and the tech markets are bouncing back – what’s not to love about Q2?

After quieter markets in 2023, we can feel the momentum returning to early-stage venture. We see excitement especially in the renewable energy space, where new routes to electrification abound, and in the AI x climate intersection, with an explosion of new companies trying to accelerate the discovery of transition-critical materials.

Against this backdrop, we continue to ask ourselves: where is long-term “planet-positive” value most likely to be created? This means we’re spending time on many of the urgent and more obvious opportunities, like industrial decarbonization, but also on areas critical to societal well-being, like elderly care and reskilling/upskilling for a rapidly shifting labor market.

Alongside these efforts, Revent’s portfolio had a smashing Q1, with achievement of several key commercial and scientific milestones and multiple oversubscribed follow-on rounds. We conducted our most comprehensive impact assessment yet (spoiler alert: the portfolio had over a 5x impact multiple performance), and hosted a number of events for founders building solutions that will move the world forward.

Looking ahead, we’re excited to bring together the climate LP/GP ecosystem at SuperClimate on June 4th, then host many of our LPs, founders, and friends at our AGM on June 6th.

And now, without further ado, here’s a brief recap of Q1:

🚀 Portfolio Updates

Our portfolio had an exciting Q1, with three up-rounds!

Electricity Maps raised an oversubscribed €5 million round led by Transition to further its vision of becoming the global data layer for grid decarbonization. Its rapidly expanding API now serves over 10 million requests per year, and has become an authoritative source of truth powering decarbonization efforts across public and private sectors, including for over 40 corporate clients. For more, see our post on Why We Invested and their TechCrunch announcement.

Two more portfolio companies are also closing fresh rounds with top-tier investors - keep an eye out for upcoming announcements!

Multiple portfolio companies had their work featured in the news & media, including:

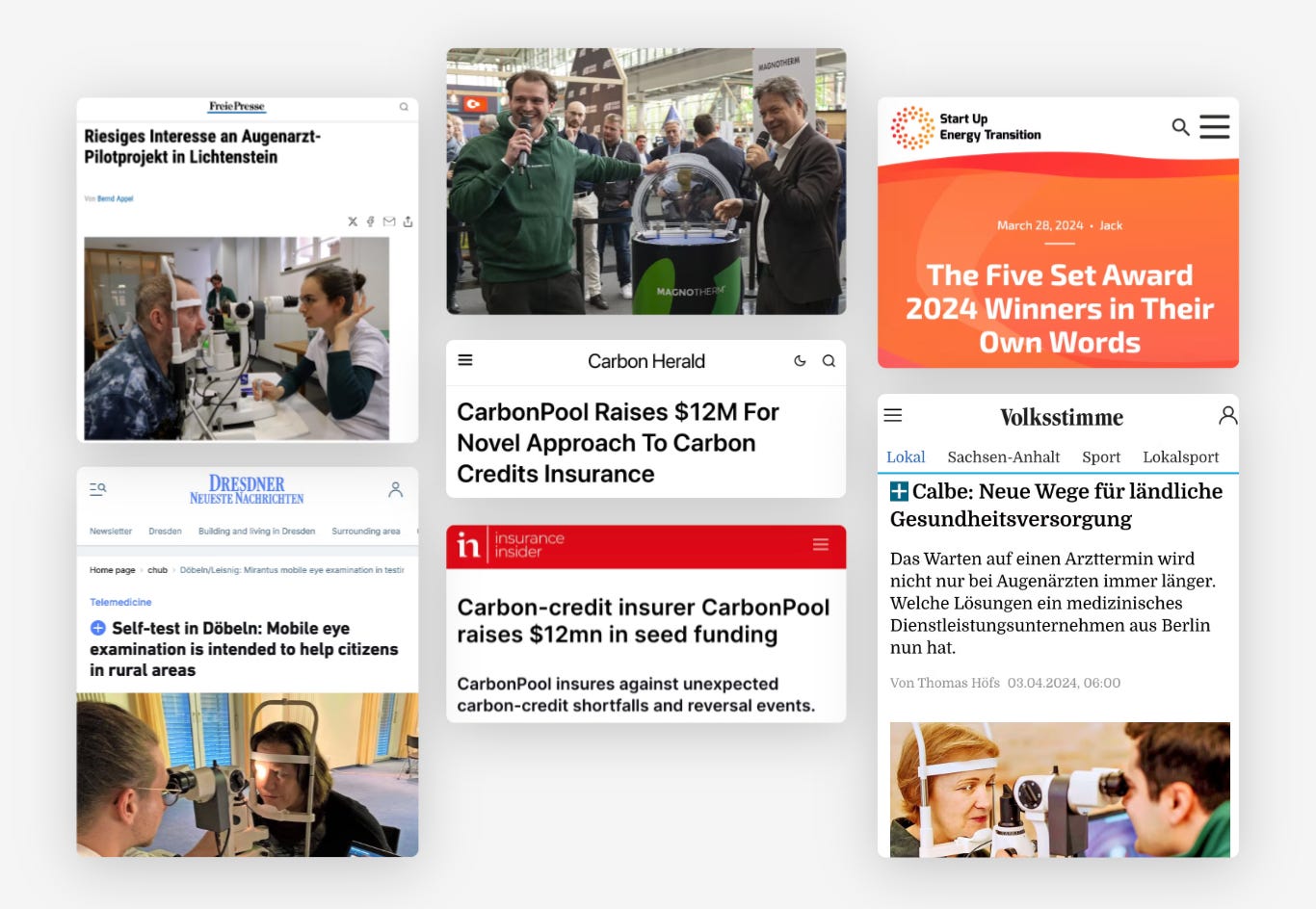

Mirantus’s mobile specialist care services were covered in multiple German newspapers, including Freiepresse, DNN, and Volksstimme.

Magnotherm’s novel cooling technology enabled it to become one of 5 startups out of 400+ global applicants selected for the Startup Energy Transition Awards; furthermore, co-founder Timur Sirman got to introduce their innovation to German Vice Chancellor Robert Habeck.

The announcement that CarbonPool is building a new kind of insurance to de-risk carbon credits made a splash in both climate and insurance circles.

🤝 Events & Ecosystem

To kick off the year, we co-hosted a Revent x Creandum climate founders’ breakfast in London, bringing together 25+ founders from top early-stage startups.

We also enjoyed meeting founders, investors, and other ecosystem partners at E-world, Hello Tomorrow, Startup Energy Transition, Q-Summit and other events!

Invitation for LP’s: Coming up, we’re co-hosting Super Climate Berlin on June 4, bringing together the top LP’s and GP’s to unlock climate finance. If you’re an LP and would like an invitation, please reach out at investors@revent.vc!

💡Opportunities to Work & Learn

Our companies are hiring for 71 exciting positions, including:

For a full list of open roles, check out the Revent job board!

In Q1, we shared our deep dive findings into:

Direct Air Capture: build your own thesis with our Thesis Map

Decarbonizing Heavy Industry: see our deep dive overview

Share your expertise: Stay tuned for upcoming dives into grid technologies, AI for health & climate, and decarbonizing chemicals. If you’re building or working in these spaces, we’d love to chat - reach out at sharon@revent.vc.