Why We Need a Digital-First Approach to Chronic Care

Revent Reflections on Chronic Care (Pt. 1)

Revent invests in tech-based solutions to the biggest problems facing our planet and society. As Western populations continue to age, chronic diseases have become our leading health challenge.

Following our inaugural Revent Reflection in Preventive Health, we dive into the world of tertiary prevention, specifically the management of chronic diseases.

In a two-part series, we focus on these increasingly common ailments of the heart, lungs, kidneys, metabolic functions (i.e. diabetes), and musculoskeletal systems.

Across two parts, we aim to answer the questions:

Pt. 1: What is digital chronic care, and why is it interesting?

Pt. 2: Where are the opportunities for digital chronic care in Europe?

If you’re a founder in this space, we’d love to connect! Shoot a message to sharon@revent.vc.

Summary

🤷♀️ What’s the problem?

Chronic illnesses like diabetes, cardiovascular disease, kidney disease, COPD and chronic pain cause major health loss and expenditures in Western countries (explore data).

As these diseases progress, they require expensive interventions such as surgery, hospitalization, or dialysis. They also raise the risk of acute episodes like strokes and heart attacks.

Chronic care aims to slow disease progression and minimize the condition’s impact on a patient’s quality of life, often through lifestyle changes.

Effective chronic care has the potential to improve the health of large swaths of the population while significantly lowering overall healthcare costs.

🤳 How can digital tools improve chronic care?

Mainstream chronic care consists of brief doctor’s visits followed by months-long periods where patients are left to self-manage with medication and lifestyle change. Adherence to these regimens can be 50% or less.

Meanwhile, studies have shown that diet and exercise enforced by frequent coaching can be more effective than medication.

Digitizing these methods moves chronic care from hospital to home, gives more access for the patient, and demands less time from care providers.

In the US, visionary companies like Omada and Livongo have built billion-dollar businesses based on digital-first management of diabetes.

Today, there are hundreds of players worldwide building digital solutions for a variety of chronic conditions, from heart failure to COPD to back pain (market map to come).

🚀 What does success look like in this space?

In our view, players in this space must produce four key proof points, combining user-centric design, business model innovation, and clinical rigor. Here, we share Revent’s “Four E’s” framework for digital chronic care:

Enrollment: How do people discover the program? Are they willing to try it?

Engagement: Do patients (and, if relevant, providers) use the platform consistently? Do they follow the program’s advice?

Efficacy: What health outcomes result from the program?

Economics: What cost savings does the program bring the client? Can the program be run profitably?

See below for what investors will ask, what to show us, which metrics to use, and examples to benchmark against.

Over the past decade, digital chronic care startups have published evidence across the “Four E’s” for myriad conditions. It is now clear that digital chronic care solutions can successfully engage users, improve outcomes, and lower healthcare costs.

🤔 However…

Despite their success in bettering outcomes and saving costs, digital chronic care startups have not yet demonstrated profitability. And there have been way fewer successes in Europe than in the US.

For our analysis on why this is, and where opportunities lie, stay tuned for Part 2: Where are Europe’s chronic care unicorns?

The Health and Financial Burden of Chronic Disease

In 2019, Germany spent over €400 billion on healthcare, while its population collectively lost 27 million healthy years to disease, as measured by disability-adjusted life years (DALY’s, a public health indicator combining premature death and loss of life quality).

Much of this burden was concentrated in a handful of chronic diseases. In fact, Germany’s top 10 causes of DALY’s - nearly all chronic illnesses - accounted for over 1/3 of total health loss and nearly 1/4 of healthcare expenditures.

Let’s zoom into the individual level with a graph. Here is the per-patient cost vs. prevalence of some of Germany’s highest-impact illnesses, excluding cancer and injury:

While chronic diseases are common, they have moderate cost and impact on a per-patient basis. Compared to cancer, which affects just ~1% of the population each year, chronic conditions are much more prevalent, affecting 5-15% of the population. However, they cost less to treat - less than €1,000 /yr vs. €50,000 /yr for lung cancer - and pose less threat to one’s health.

However, if left unmanaged, lifestyle-driven chronic diseases can lead to high cost, high impact health events. Diabetes, for instance, doubles an individual’s risk of heart attack or stroke. These acute conditions cause up to 10x greater cost and impact than diabetes itself.

This is why preventive management of chronic disease is so important - it has the potential to improve the health of large portions of the population while significantly lowering healthcare costs.

The Promise of Digital-First Chronic Care

While chronic conditions have plagued Western societies since the early 20th century, their treatment regimes have been inherited from an era of acute illness: 30-minute visits to the doctor are separated by months-long stretches where patients are left to self-manage.

Meanwhile, evidence has mounted behind the power of behavioral change to improve health outcomes. In 2002, the US Diabetes Prevention Program, a randomized control trial of more than 3,000 people, announced landmark findings: lifestyle intervention - dietary changes, exercise, and hands-on support from case managers - proved nearly twice as effective as medication at reducing disease incidence.

In 2011, at the dawn of the smartphone era, a Harvard student named Sean Duffy came across the study’s methods and saw the potential to deliver them through a digital app. Duffy dropped out of school to found Omada Health. In 2014, ex-Allscripts CEO Glen Tullman spun out a similar concept from a glucose monitoring device maker, creating Livongo.

Many would call these two companies the original visionaries of digital chronic care. Throughout the 2010’s, they would attract funding from top VC’s like A16Z and General Catalyst. Their success inspired entrepreneurs around the world to build digital-first approaches for conditions like musculoskeletal pain, COPD, and more.

Thanks to a digital-first approach, chronic care could finally follow patients out of the clinic and into their everyday lives.

Succeeding in Digital Chronic Care: “Four E’s” Make a Flywheel

Before we consider the future of digital chronic care solutions, let’s first understand how they work. In order to succeed, a digital chronic care solution needs to own the intersection of user-centric design, business model innovation, and clinical rigor.

First and foremost, a digital chronic care solution usually needs approval as a medical device. We will not elaborate on the regulatory process here - for this, we refer you to this useful library by DTx Alliance.

Then, chronic care programs must produce four interlinked proof points, which we call the “Four E’s”: enrollment, engagement, efficacy, and economics. While it takes serious investment to generate these proof points, the result is a flywheel that drives scale and success.

Proof Point #1: Enrollment

Enrollment is the beginning of the user journey for a digital chronic care platform. Eligible patients discover and enroll for the program through various channels, including:

Direct-to-consumer marketing: may allow a startup to quickly generate proof points, but difficult to scale

Insurers / health plans: offer scalability, but require proof of Efficacy and Economics. Enrollment is also complicated - first, the insurer agrees to pay for their covered population to access the solution. Then, eligible individuals must choose to enroll and participate in the program.

Employer programs: self-insured employers have been early adopters of US chronic care solutions, offering scalability, but European companies tend to be less hands-on in their employees’ healthcare

Prescriptions through providers: requires evidence of Efficacy and can have network effects, but may still pose scaling challenges as evidenced by low prescription rates of Germany’s DiGA’s

Digital companion to a pharmaceutical drug

What Investors Will Ask: How do users discover the solution? How many are willing to try it?

Show Us Proof of:

Initially, enough Enrollment to generate early indications of Engagement and Efficacy (see below)

Then, the ability to enroll users through scalable channels such as health plans, employers, and provider networks

For organizational channels, enough enrollment must be generated to be both “sticky” for the client organization and cost-effective for the startup (customer acquisition cost < lifetime value).

Use These Metrics: Number of users, enrollment rate, customer acquisition cost etc.

Benchmark to these examples:

In the UK, Oviva reports 73 - 86% uptake of its diabetes and weight management programs after patients receive an NHS referral.

Livongo has seen 30 - 50% enrollment of eligible client population, once signed with a health plan or employer.

Proof Point #2: Engagement

Once enrolled, users are provided with a digital management plan via an app.

The app serves two main goals:

Remotely monitor the user’s condition and disease progression, allowing for proactive intervention, and

Help the user manage their condition, lowering the risk of adverse health outcomes.

Towards these goals, digital chronic care programs can offer a combination of features:

Customized management instructions

Sensing, testing and reporting of key biomarkers (weight, blood pressure, blood sugar etc.) - sometimes with accompanying hardware

Automated and/or live coaching for healthy behaviors (diet, exercise etc.)

Educational content

Medication tracking and reminders

Member communities

While completely automation is possible, human providers are often kept in the loop to optimize treatment plans and boost accountability. This can consist of sharing a patient’s live health status with their primary care physician, who can intervene as needed. Alternatively, many digital chronic care platforms now hire virtual health coaches to support patients throughout the program.

As we highlighted in “What’s preventing preventive health?”, behavior change is really hard. Ultimately, an engaging user experience, seamless remote monitoring, and human providers-in-the-loop must form a continuity of care that enables patients to keep coming back.

What Investors Will Ask: Do users use the solution consistently? Do they follow its advice?

Show Us Proof for:

Robust user engagement - frequent use, consistent biomarker logging, chat interactions etc.

High program completion - users adhere to and finish the program

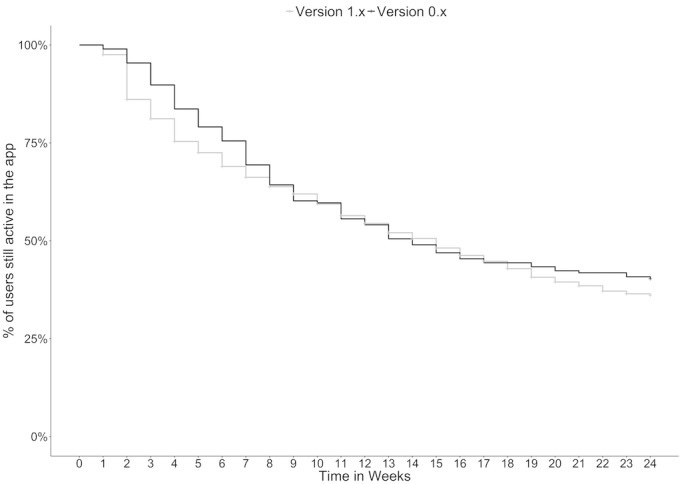

Use These Metrics: user retention, use frequency, program adherence, rate of program completion, net promoter scores etc.

Benchmark to these examples:

A clinical trial for of Virta’s program for Type 2 diabetes, one-year retention rate was 83% and two-year retention rate was 74%.

In a study on Oviva’s diet program for diabetes management, “93% completed the total diet replacement (TDR) phase; 89% of TDR starters completed food reintroduction. 68% completed the 12 month programme.”

Proof Point #3: Efficacy

As patients go through the program, their symptoms regress (in the case of diabetes) or disease progression slows (for irreversible illnesses like COPD and chronic kidney disease). The risk of adverse health events like heart attack, stroke, and hospitalizations decrease. Clinical trials should be used to document these results.

What Investors Will Ask: What health outcomes result from the chronic care program?

Show Us Proof of:

Significant improvements of health outcomes

Decrease in frequency of acute health episodes

Clinical trials that demonstrate the above

Use These Metrics:

Clinical indicators for each disease area (blood sugar for diabetes, pain levels for musculoskeletal conditions, eGFR for kidney disease etc.)

Underlying risk factors (weight, blood pressure, cholesterol etc.)

Rate of acute health episodes (complications, hospitalization, surgery etc.)

Benchmark to these examples:

Kaia’s 30-day program for COPD produced a clinically significant improvement in their Chronic Respiratory Disease Questionnaire scores

Aidhere’s DiGA for obesity, Zanadio, produced on average an 8% sustained weight loss in its users

Proof Point #4: Economics

Time to bring it back to business!

Most successful digital chronic care platforms sell to payers. In the US, payers include self-insured employers, insurance health plans, and private value-based care health organizations. Europe, in contrast, is dominated by public or heavily-regulated payers such as the UK’s National Health Service and Germany’s sickness funds.

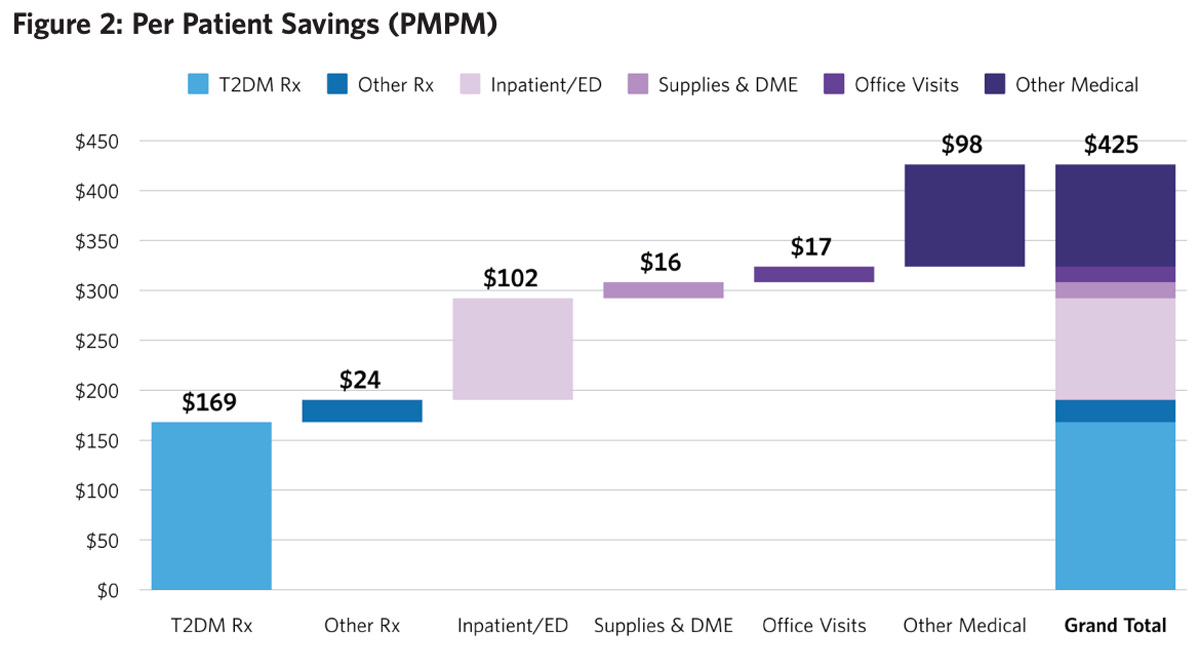

Regardless of the payer, it is vital for a chronic care program to show return on investment. Usually, this means the program prevents the cost drivers of chronic conditions, such as emergency care, hospitalization, or expensive long-term treatment (medications, dialysis etc).

What Investors Will Ask: What cost savings (if any) does the chronic care program bring the payer? How will you run the program profitably?

Show Us Proof of:

Significant cost savings attributable to the program’s clinical outcomes

That the cost savings for the payer are greater than the price tag of the program = profit for the payer!

That the price tag of the program is greater than the cost to implement it = profit for the startup!

Use These Metrics:

Change in per patient per month/year healthcare costs

Benchmark to these examples:

Chronic kidney disease patients in the US who adhere to Somatus’ program reduce their medical costs by 13% ($338 per member per month)

Virta’s diabetes program saves clients $425 per patient per month

However, no digital chronic care startup has publicly announced profitability… yet.

Stay Tuned…

While we have seen multiple US-side unicorns scale through this flywheel, there is a clear shortage of similar success stories in the European market. In Part 2 of this series, we will consider why this is.