TechBio - What is it and why is it 💥?

For the last two years, I have been on a weird and wonderful journey exploring the exciting world of TechBio with an investor’s hat on. As someone who enjoys helping others avoid the pitfalls that I have rather unceremoniously fallen into, and the steep learning curves (having puffed up a few), I have decided to start a series of blog posts that are a collection of learnings that hopefully bring value to both investors and start-ups alike.

But firstly, for the time-sensitive among you, here is the TLDR:

TechBio (by my own definition) is a combination of applying both technology (compute code) and biology to produce a desired end product. An analogy (that has many flaws, but establishes a decent basis) is that organic materials are the ingredients (the bio) and technology (the tech) helps us determine the right recipe.

Nevertheless, as a rapidly evolving field, TechBio is a difficult-to-define term with applications ranging from diagnostics to carbon capture. Recent advancements in:

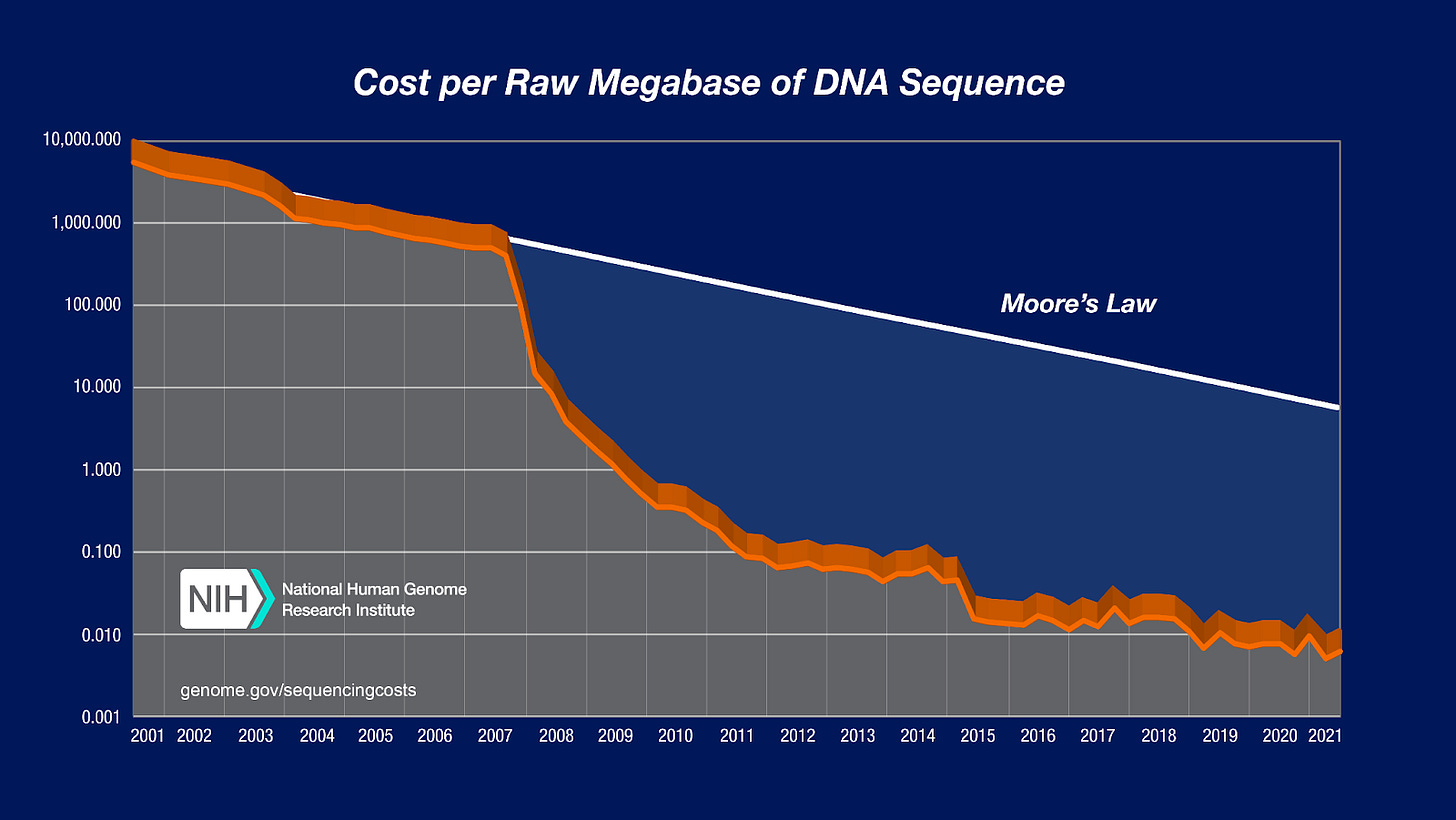

Tailwind 1: DNA sequencing

Tailwind 2: Decreasing computing costs, automation, and the use of AI and ML are unraveling the complexities of biological data and its potential is now expanding beyond the realms of pharmaceuticals.

Tailwind 3: Additional tailwinds driving the development of the TechBio field are climate change pressures, which are pushing industries to adopt nature-inspired technologies to reduce carbon emissions. While the tech market evolves, TechBio offers many exciting investment opportunities that merge the physical and digital worlds. However, challenges still exist for TechBio founders that I will nod to in this blog, but will elaborate on further in future articles.

Tailwind 4: See below ;)

Has led to a boom in new TechBio start-ups being built over the last few years which has piqued the attention of many sources of capital. This in turn has led to an interesting evolution in how founders raise funds as this sector gains momentum; the good news - there is more capital available, the bad news - understanding which VCs are open to what kind of investments has become increasingly challenging.

This article serves to provide value to both sides of venture:

Founders, see the diagram below for an overview of how investors might decipher what kind of business models/sector areas they are open to investing in. Additionally, insert any relevant content you find into slide 2 of your pitch deck to warm up generalist investors to explain “why now” is the right time to invest.

Investors new or keen to explore the space, below are some of the potential areas to double down on depending on your investment strategy and some content that TechBio founders would hope you would know before hearing them pitch to you.

Favorite quote: ‘Right now, we are at the juncture of realizing we need the ability to engineer bio, and a fuller ability to engineer it (i.e., we’re still in the installation phase). In the tech industry, the analog period for the web led to the creation of massive companies like Amazon and Google. Given the power of the combined trends — and the scale of the challenges — we should expect to similarly see the rise of a few potentially trillion-dollar companies at scale: the equivalent of a Bio GAFA, finally.’ Vijay Pande, Partner at a16z

Most useful resource: TechBio investors can be found here and of course, Revent ;)

Teaser for the next blog: TechBio is certainly not always the right technology for building an end product….

The definition

What do I mean by the term, TechBio? It is hard to wrap a single word around the range of different businesses that I have evaluated, as they span across so many different verticals. TechBio (by my own definition) is a combination of applying both technology (compute code) and biology to produce a desired end product. Perhaps another more detailed definition (again, in my opinion) is that TechBio covers any technology that either enables the development or commercialization of biology-based science or uses nature (or is inspired by nature) to power its end product.

Subsequently, this definition can span across anything from mantis shrimp-inspired vision technology 🦐 🌈 to biofuel-leaking algae 🦠🫠 - yes I have been pitched both things!

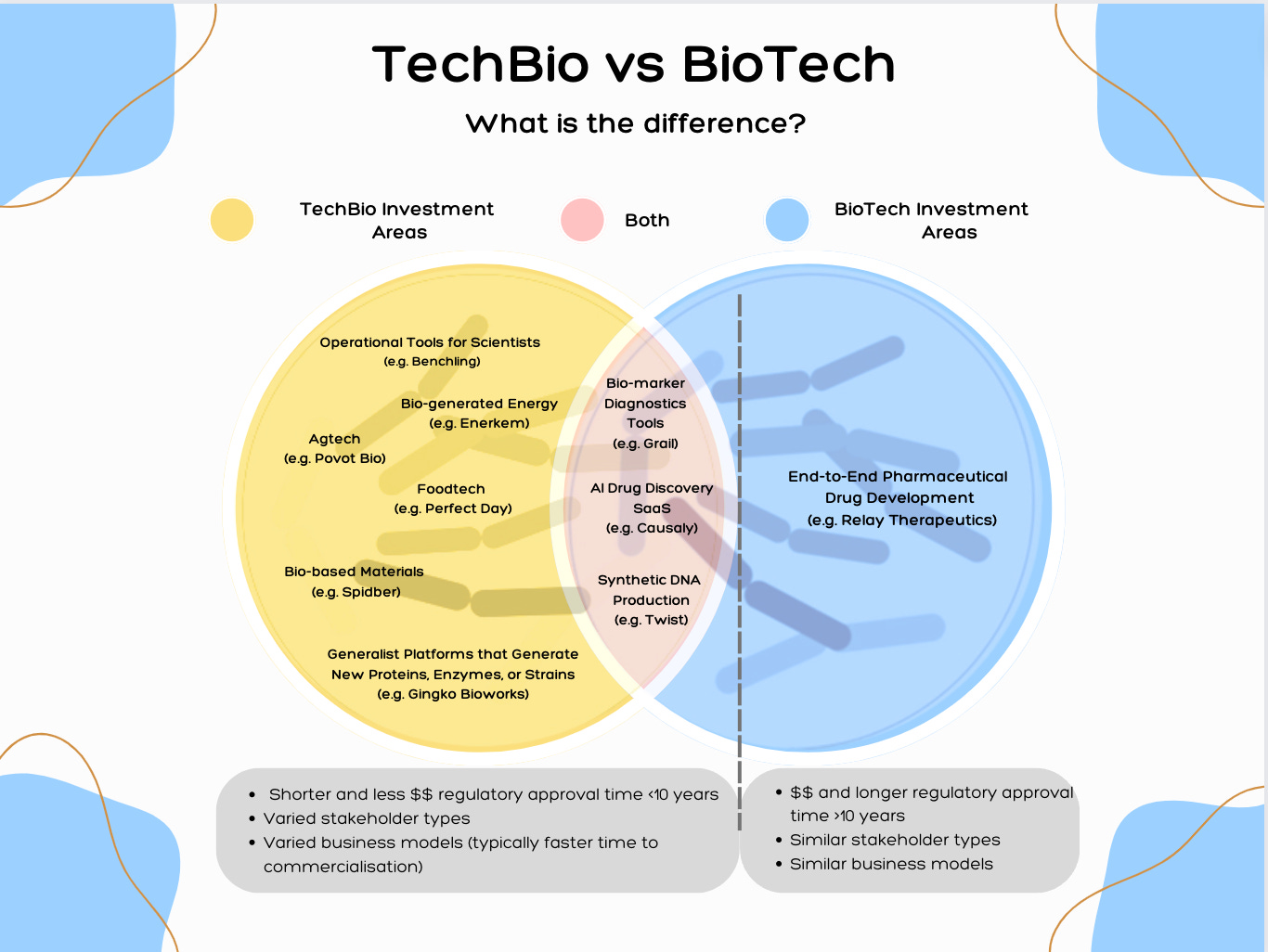

BioTech vs TechBio what is the difference?

For a long time, BioTech or Life Sciences funds stood apart from the ‘generalist’ VC world. BioTech funds typically have a very different strategy from generalist tech funds, and historically, very rarely did their paths cross, as most startups that BioTech funds invest in are related to pharmaceuticals. Pharmaceutical drugs have to go through rigorous clinical trials, which require vast sums of money and a lengthy regulatory cycle for a drug to reach the mass market. If a portfolio company produces just one successful drug, then BioTech firms have a potential multiple billion dollar outcome on their hands. Here is a great overview of how BioTechs strategize to maximize their portfolio’s value and most importantly when to exit.

However, this pathway does not fit with the typical strategy of a generalist fund where diversification is the name of the game - the distribution of different business models and industry sectors (in theory!) is a strategy to increase the chances of investing in a winner and protect against one industry tanking.

To spin the explanation into another analogy (sorry not sorry) - TechBio firms put all their eggs in a trillion-dollar basket. Generalist funds put their eggs in many industry-type baskets (cuckoo-bird style ;) ).

Excitingly, over the last few years, the lines between BioTech and generalist funds have blurred as we have seen more and more innovation with nature-based solutions not only accelerating developments within healthcare and pharma industries but also across many other verticals. These verticals could be perceived as more ‘generalist friendly,’ i.e. shorter timeline to exit, different customer profiles, less stringent regulatory requirements, more scalable business model etc.

In summary, within the last ten years two phenomena have happened :

Pharma companies have embraced tech to develop drugs

There has been a growth in startups that use nature-inspired solutions outside of pharma

One way to taxonomize the two areas is: BioTech is a subcategory of TechBio that is focused on developing clinical grade pharmaceuticals/medical grade equipment for commercialization. Below is a diagram that depicts how the two investment areas interact with one another based on this taxonomy.

Europe is renowned for its scientific talent due to its high number of world-renowned academic and research institutions, and we are seeing increasing numbers of technologies being spun out into commercial applications. In 2021, European TechBio startups raised $8.5bn, and TechBio is now starting to get a bigger share of that funding (unfortunately major VC trackers are blending BioTech and TechBio categories together).

Along my journey, I have explored the key question, why now? Why are we seeing an influx of many new TechBio start-ups? I have come up with several reasons, but I welcome more.

Tailwind #1: Accessibility of DNA sequencing

Advancements in science have been extraordinary in recent years, but one specific development that has arguably accelerated the TechBio world the most is the speed increase and decreasing cost at which DNA is sequenced, as outlined by this graph below.

The nucleotides that makeup DNA can be analogous to data code, acting as the ‘back-end’ or ‘instruction manual’ for the desired end product. However, over many thousands of years of evolution, DNA code has become billions of nucleotides long (around 3 billion in humans to be more specific). It was only twenty years ago (2003) that the Human Genome Project published the entire human genome, through this momentous scientific breakthrough, scientists are now able to start deciphering how DNA translates into organism function.

A factor that has enabled rapid DNA sequencing is advancements in computing processing. In order to store DNA code in digital form, a single human genome takes up 100 gigabytes of storage space. In short, humans have designed a storage system far less efficient than nature! But we are making progress. Just ten years ago, processing and storing 100 gigabytes of data would have been incredibly expensive, but due to the development of technologies such as semiconductor optimization and cloud data storage, the cost of data processing and storage has decreased by 90%.

For those who are curious to learn more about this space, check out these links:

Academic/Informative Media:

Successful Startups that are deciphering the human genome:

Illumina - Raised $778m from investors such as Venrock. IPO’d in 200 at a valuation of $3b, current valuation at $32b (2023)

10x Genomics - Raised $242m from investors such as Fidelity Management, SoftBank Vision Fund and Paladin Capital Group. IPO’d in 2019 at a valuation of $3.7b, current valuation $4.58b (2023)

European leader: Oxford Nanopore Technologies - Raised £994m from Temasek Holdings, IP Group and Wellington Investment. IPO’d in 2021 at a valuation £3.4b, current valuation £2.36b (2023)

Ultima Genomics - Raised $600m from Andreessen Horowitz, Founders Fund, General Atlantic, D1 Capital, Lightspeed, aMoon and Playground Global and Khosla Ventures

Element Biosciences - Raised $401m from investors such as Fidelity Management, Foresite Capital, Venrock

Useful quotes:

“The global genomics market could reach USD 54.4 billion by 2025, driven by a double-digit growth rate during the next five years.” Genomics Market by Product & Service

"In 2025, as many as 2 billion people could have their genomes sequenced." - Big Data: Astronomical or Genomical?

“At this cost point (referencing the cost point of their recent investment, Ultima Genomics), there’s so much you can do around early detection of cancer or characterizing your own gene repertoire” Khosla Ventures founding partner Samir Kaul

Tailwind #2: The use of automation and AI in science

Not only do we have the opportunity to process and store DNA cheaply, but the most exciting opportunity arises when we can analyze the data and understand its functionality; thus, DNA sequencing is the first step that makes up a long road to establishing how we can cure, improve and/or take full advantage of what nature has to offer (i.e. commercial and non-commercial opportunities).

Humans are notoriously bad at remembering and dissecting reams of information - tell me, what did you have every day for lunch during the first week of January 2013 - erh 🥪? It is not our fault that our brain is trained to forget to overload on useless information… until it is not useless - now where did I put my keys? 🗝️

However, this is where the power of AI comes in; AI can be harnessed to not only help process this data but also to predict, based on a series of rules, the functional output of our DNA code. Nature is exceptionally complex as nucleotides can be inherently linked to one another; think of our bodies as a byproduct of millions of chain reactions, many of which are interdependent on one another; these reactions are not only influenced by our DNA but also external factors such as temperature, what we put into our bodies, sunlight exposure, the external variables are almost endless and in many cases hard to predict in real-world conditions. Subsequently, it is often too difficult for our brains to comprehend all the factors at play, but excitingly, it is argued by many that AI can help us unravel all of this complexity. With ‘generative AI’ being the hottest topic of 2023, the application of this exciting technology could be transformational, if adopted by the scientific community.

So now we have the DNA data uploaded into a digital format, and we are starting to understand how biological code translates into output, have genetic modification technologies such as CRISPR, and are currently building the AI tools to interpret the most powerful system in the world. An exceptional trifecta - what a phenomenal time to invest in this space, would you not agree?

Perhaps not, playing devil’s advocate here, as with any data-driven decision, without quality data and a good understanding of the relationships between variables, the output of ML models can be poor. It is important to highlight that ML/AI is not a magic wand and extracting key and correct data points from nature still requires a lot of physical processing which is costly and time-consuming.

Another analogy(ish) is coming up… before AI, scientists would just guess the combination of the 1,000k+ digit code to a padlock that seemed to increase the odds of unlocking it. With AI and ML, scientists use historical data and assumptions to generate an algorithm to automatically generate different combinations to unlock the lock. My point - it is still hard. 🔑🔒🔑🔒

For those taking your research a bit further, here are some resources:

Academic/Informative Media:

Successful start-ups using ML

Generate Biomedicines - $420m from investors such as Fidelity Management, Morningside Venture Investments and Flagship Pioneering

European Leader: Peptone - raised $42.2m from investors such as Bessemer Venture Capital, Walden Catalyst, and F-Prime

European Leader: LabGenius - raised $28.7m from Lux Capital, Atomico, Kindred Capital, and Airstreet Capital

Useful quotes:

“Smart Life Sciences Manufacturing Market Worth $78.97 Billion Globally by 2033” Insight Partners

“The global artificial intelligence in healthcare market size is projected to cross the USD 187.95 billion exchange rate by 2030 at a CAGR of 37% during the forecast period of 2022-2030.” Precedence Research

“In drug discovery, an active learning algorithm identified 57 percent of the active compounds by performing 2.5 percent of the possible experiments, compared with 20 percent identified through a traditional approach of building a model for each target.” National Academies of Sciences, Engineering, and Medicine

“As software “eats” every step in the life sciences value chain — from discovery to development to distribution of new medicines — the industry will have to continue engineering new processes at each step, in order to actualize the productivity gains made possible by machine learning. In other words, new tools are required. Today, bio companies developing new therapeutics and diagnostics are also building new tools with which to engineer biology out of sheer necessity.” Julie Yoo, A16 general partner, and Justin Larkin, partner, bio + health team

Tailwind #3: Climate Change pressures

A sad but true fact is that by burning fossil fuels and using inefficient production practices to power our world, we are slowly but surely destroying it. If we reach just two degrees Celsius warmer than pre-industrial times, it increases the chances of floods, storms, droughts, and heat waves by five times, resulting in billions of people at risk of climate change-derived events. Last year, the earth was 1.1 degrees Celsius above pre-industrial times, so it can be safely assumed that without drastic changes, we will end up in a world where the earth will become uninhabitable to humans. Mars really could start to be as appetizing as its confectionary namesake.

It is only in the last decade or so that humans have taken note that we are heading towards catastrophe. However, thankfully, we have now (hopefully) reached a critical mass of individuals who have dedicated their lives to resolving this problem leading to a series of initiatives and legislations being put in place that will force the way we, as a species, consume. Some key initiatives that are forcing change are;

The 2050 Paris Agreement: To keep global warming to no more than 1.5°C – as called for in the Paris Agreement – emissions need to be reduced by 45% by 2030 and reach net zero by 2050

Biden’s Executive Order: The National Biotechnology and Biomanufacturing Initiative, a “whole-of-government” effort to further biotechnology and biomanufacturing innovations in health, climate change, energy, food security, agriculture, supply chain resilience, and national and economic security. The Initiative would cost $2 billion

The Climate Pledge: Neutralize any remaining emissions with additional, quantifiable, real, permanent, and socially beneficial offsets to achieve net-zero annual carbon emissions by 2040

Corporate Sustainability Reporting Directive: A set of large companies, as well as listed SMEs, will now be required to report on sustainability within the EU

Securities and Exchange Commission - The Enhancement and Standardization of Climate-Related Disclosures for Investors: requires all publicly traded US companies to disclose emissions

To bring things back to science, a simple chemical reaction is heating the world, and the earth’s delicate ecosystem, which for billions of years existed in a complex cyclic rhythm, is shifting off-kilter. What better way to resolve our mistakes than using nature? Excitingly, there are a number of companies that are flooding into the market that are doing just that.

A term that you often hear bandied around is Life Cycle Analysis (LCA), in essence, this is a process where typically a third party calculates the amount of carbon dioxide that is generated to produce the desired end outcome. Scientists around the globe are working on technologies that considerably reduce (or in some cases capture) the amount of Carbon Dioxide produced (or in some cases increase Carbon Dioxide absorption) many of which take inspiration from nature. However, the question remains whether nature-based solutions can help reverse the damage we have done in a way that is economically viable and scales rapidly, and thus an attractive VC case.

Academic/Informative Media:

I will cover interesting start-ups in future articles.

Useful quotes:

“PitchBook estimates the climate tech market will near $1.4 trillion, representing a compound annual growth rate of 8.8%” Techcrunch Article

“By the end of the decade, syn-bio could be used extensively in manufacturing industries that account for more than a third of global output—a shade under $30 trillion in terms of value.” BCG

“According to the 2022 survey, which surveyed 900 clients from its private bank and business banking division globally between the end of July and August this year, 53% of investors regard climate change as the most important factor affecting their investment decisions, up from 47% last year. Other environmental issues were less important to investors such as land degradation (21%), ocean pollution (15%) and biodiversity loss (7%).” Deutsche Bank Wealth Management

SaaS is starting to do some maths…

The three driving factors that I have outlined above are trends that, for those in the know, have been gathering strength for the last five years; in contrast, the dip that we have seen in the public and private markets has only truly come into play in the last 12 months or so. So take this point with a pinch of salt as we all know, financial markets are one of the world’s mysteries (until hindsight kicks in) and can change on a dime.

However, my prediction is that the returns we have seen from the tech giants of this world will unlikely be maintained in the next ten years. Instead of seeing 40x enterprise valuation/revenue multiples, the market has started to normalize valuations to match the average - put simply, the bottom line is the new top line. Additionally, a typical pattern following a recession is investors, both public and private, turn to physical assets, those that are tangible and finite in their existence. Subsequently, I think that now is an exciting time to explore businesses that merge both the physical and digital. However, this does require a significant shift in the typical Venture Capital mindset - and excitingly, it seems like we are just on the tailwind of this new trend.

What will I be exploring in the upcoming year?

I will be diving deeper into various TechBio technologies that can transform our society; I will also be addressing how I evaluate businesses within this sector, dissecting some failures and discussing the big regulatory changes we are seeing and highlighting some start-ups, investors, and accelerators that are driving these technologies into commercial applications. Stay tuned!

If you are a start-up working in the TechBio space, please reach out on Linkedin!