Introducing the Real Value Framework

Revent’s Unified Theory of Impact & Capital

At Revent, we believe capitalism needs to evolve. The incentives of markets can (and should) be harnessed to tackle society’s most pressing challenges. In fact, it’s been our belief since the start: companies solving real societal and planetary problems are the companies truly worth investing in.

We also believe that those willing to address these critical issues must see compelling financial returns for the risks they undertake. The fundamental challenge? Pinpointing exactly where these dual opportunities exist and sizing the potential value of a solution.

Introducing the Real Value Framework

We've built an approach precisely for this challenge. We’re calling it the Real Value Framework: a unified framework for impact & capital.

The framework translates human and natural capital directly into financial terms. This allows us to not only understand the scale of a problem, but also quantify the financial upside potential of solving it. It's a first-principles method to systematically identify impact markets: sectors where societal costs intersect with massive economic opportunity.

Designed explicitly for venture investing, this framework focuses on identifying and evaluating the most capital-efficient pathways, the "strike zones", to drive returns for People and Planet.

Traditional impact methodologies stop at the point of an activity-level impact (e.g. CO2 avoided, or time saved). The key innovation here is being able to seamlessly move between financial, human and natural capital. This innovation is driven by our translation factor database, which captures the latest research in environmental and social change, and this consolidation represents a big step forward in the industry.

Understanding the magnitude of potential impact is analogous to the opportunity cost to society of taking no action. We can both identify interesting markets upon which to focus and, importantly, size the value of a potential solution also with respect to the value it will drive to society, in financial terms.

The Theory

Historically, society adapts to major inflection points, but adaptation always comes at a significant cost. Inflections produce systemic gaps and externalities: concrete, measurable problems waiting to be solved.

There are many examples that prove out this thesis: An inflection emerges, mounting societal or environmental costs trigger a reactive response (often through regulation or technological innovation), and eventually, the system adapts. The catch? This reactive cycle often incurs enormous financial, environmental, and human costs before solutions mature.

Consider industrialisation. The 1800s saw rapid fossil fuel combustion, creating severe air pollution. At its peak, London’s air quality was so poor that 1-in-350 people died from bronchitis (Our World in Data, 2017). Society adapted, but only decades later, via regulations like the Clean Air Act (UK, 1936) and technological innovations such as flue gas scrubbing.

What if we could dramatically accelerate adaptation, reducing the human and environmental toll in the process? This represents our "opportunity window."

Increasingly, the scale of these problems is being quantified financially by governments, international NGOs and academic researchers, to closer align policy design with impact outcomes, think, social cost of carbon or disability adjusted life years (DALYs). This is allowing us to clearly visualise the size of the opportunity in any given sector.

Real Value in Practise

Take chronic disease in Europe, a market worth over €1 trillion in human capital annually. Or decarbonising freight and logistics, an opportunity exceeding €163 billion in natural capital per year. By identifying these markets upfront, we narrow our investment focus to areas with the most substantial combined potential.

Here's a concrete example: Demographic shifts, specifically ageing populations and the rise of chronic diseases, mean European healthcare costs will dramatically increase. An AI-driven medical documentation tool that saves doctors just 30 minutes daily addresses an impact market worth €100 million in human capital annually in Germany alone.

We have replicated this calculation across our climate and health investment themes, setting a practical hurdle: potential investments must demonstrate a human or natural capital potential exceeding €100 million, analogous to a basic ARR benchmark that sees €100 million in revenue translate into a €1 billion valuation. In other words, we're hunting for "impact unicorns".

Operationalising the Framework

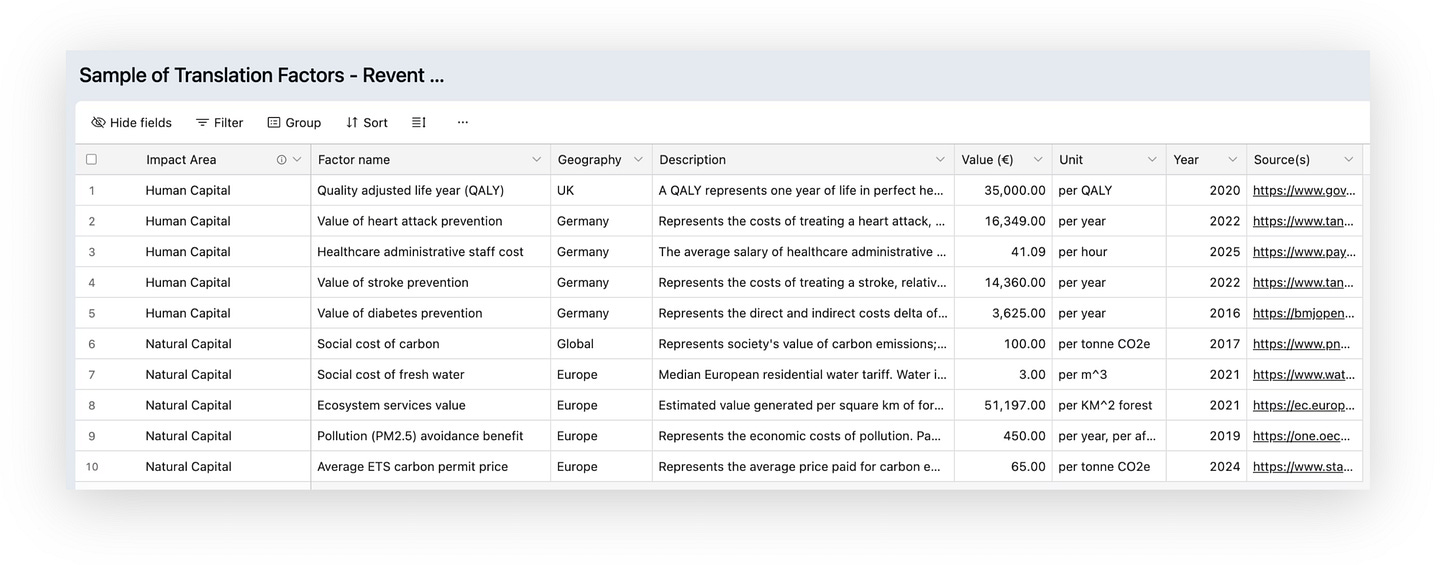

We have developed a database of translation factors that allows us to quantify the impact potential across our investment focus areas of health, climate and empowerment.

We are excited to be publishing the first version of this database, accessible by anyone on the link below. We have chosen to publish this MVP version of the database to gather feedback and ideas from others, we want this to be collaborative.

The factors are sourced from a range of credible research organisations and government bodies, such as the European Commission, UK Gov and OECD. We will be updating these over time as the world moves forward, for example as the grid decarbonises, or as inflation drives up doctors’ wages.

We want this to be be utilised by other investors who also want to invest in companies based on the real value they create, in human and natural capital.

Where Next?

We're serious about aligning financial returns with tangible societal and environmental benefits. If our financial target is a >4x return, our portfolio must correspondingly generate human and natural capital gains at the same scale. This is the goal we are setting for Fund II.

We will continue to work on this framework, including expanding the translation factor database as we explore new sectors. Some areas of development that we’re looking at:

Incorporating ‘net impact’ as a way to conceive potential negative impacts of a given company, analogous to ‘net profit’.

Expand the tooling to make calculations more automated - think, a free version of the tool for others to use. So far we have published the MVP version of the database, which we will continue to develop.

We're convening a select group of forward-thinking investors and founders eager to explore and refine this approach further. If you share our ambition, we want to hear from you.

Reach out directly at albert@revent.vc.

This is really interesting - thanks for sharing the translation factors database MVP